Click-based opportunity to accounting: eliminating gaps between sales performance and financial accountability

- Standalone finance and accounting system necessitating keystrokes to capture information

- Replication of accounts and sales information between Salesforce and accounting system

- Lengthy latency between sales month-end and finance reporting of accurate numbers: source of conflicts

- Introduction, assessment, scoping and implementation of single-source-of-truth finance solution

- Working natively in Salesforce leading to finance team using Sales team’s real-time data

- Keystroking of basic finance and accounting operations migrated to clicks

- Over 30% of time saved by FinOps team in the first month of adoption

- Month-end management accounts reporting times down to hours and not days or even weeks

- Collaboration between the sales and finance teams to automate more rather than conflicts

Our client runs a sales-focused organization where the sales team are incentivized (through commissions) based on the closed sales achieved on a monthly basis. It’s a fast moving environment with aggressive targets and a results-oriented culture turning over around £1m pounds every month.

The finance team of the organization were three in number and faced downstream challenges of ensuring the sale numbers recorded by the sales team are indeed the right numbers hitting the books. The FinOps team used Sage50 and unsuccessfully tried Sage200 to streamline the finance processes. Among other challenges they faced, the most important one concerning the sales team was the time it took to complete the month-end accounting. This lengthy latency – which the finance team couldn’t help though they were working very hard – left all parties frustrated. The senior management had to wait to get a pulse of the business performance, the sales team weren’t sure about their commissions and the finance team were stressed.

The finance director and the controller consulted us on the situation and after assessing the AS IS state of the org suggested the finance team to consider bringing the accounting system inside Salesforce establishing a single-source-of-truth. The change was scary since the team had to move away from the comfort of the known and into the realms of unknown. However, the leadership knew that all change is uncomfortable and implementation of a finance system within Salesforce will lead to long-term growth and will relieve short-term pain points for the organization.

We considered FinancialForce, Accounting Seed and Sage Intacct (which had integrations to Salesforce) as potential solutions. FinancialForce was ruled out on price and Sage Intacct on the grounds of the need of API integration to Salesforce (which is another potential point of failure) and the client selected Accounting Seed.

Image 1: Accounting Seed system natively within the Salesforce org

The implementation process involved reorganizing the client General Ledger Accounts and slightly restructuring their Accounting Processes. It also involved extensive work on data migration which we helped the client with by managing the templatized ETL process. There were a few gaps in the reporting functionalities that the client had gotten habituated to. However, since Salesforce offers flexible build capabilities we build custom reporting functionalities within the system for the FinOps team to get their reports through clicks. Many rounds of build demos and adoption training were provided to the client with Brysa’s team of certified chartered accountants who were experts in Accounting Seed.

The system changes that the sales team faced were negligible. They continued on following their sales opportunity processes withing Salesforce as normal. Once the implementation was completed, the FinOps team ran the finance and accounting processes in the outgoing Sage and incoming Accounting Seed systems in parallel for a few weeks. This was challenging since it involved the team stretching beyond their BAU – however, the excitement and the promise of a more streamlined system meant the team morale was high and they learned the new system quickly. The sales team were also advised on the impending finance changes. Though their processes changed little they were looking forward to quicker validations of their numbers from the finance team.

The adoption of the system in the production org to run the day-to-day finance lead to immediate efficiencies. The FinOps team no longer had to get extracts of sales information. They could see everything in the same system. They also needn’t recreate account records in the finance system which saved them time. The team estimated that more than 30% of their time doing repetitive, avoidable tasks were saved because of the new system implementation.

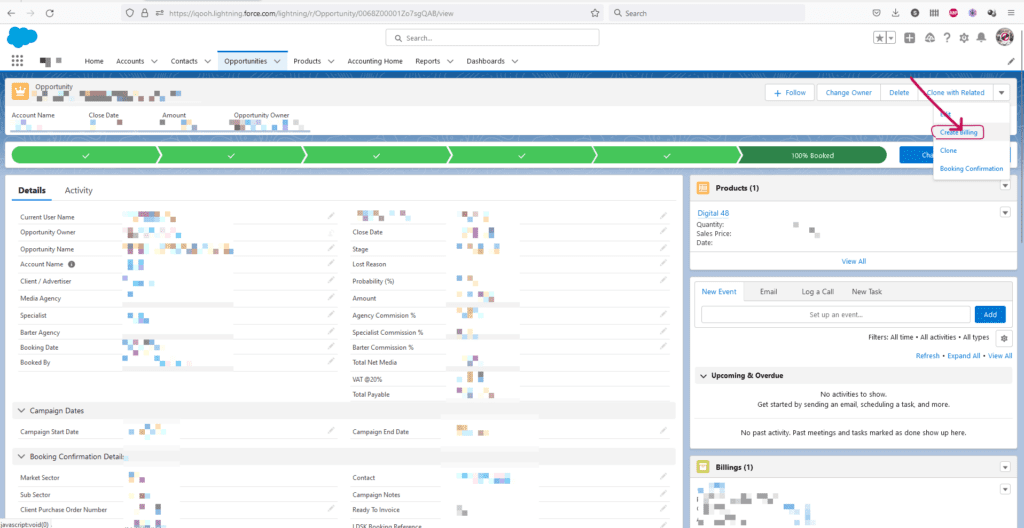

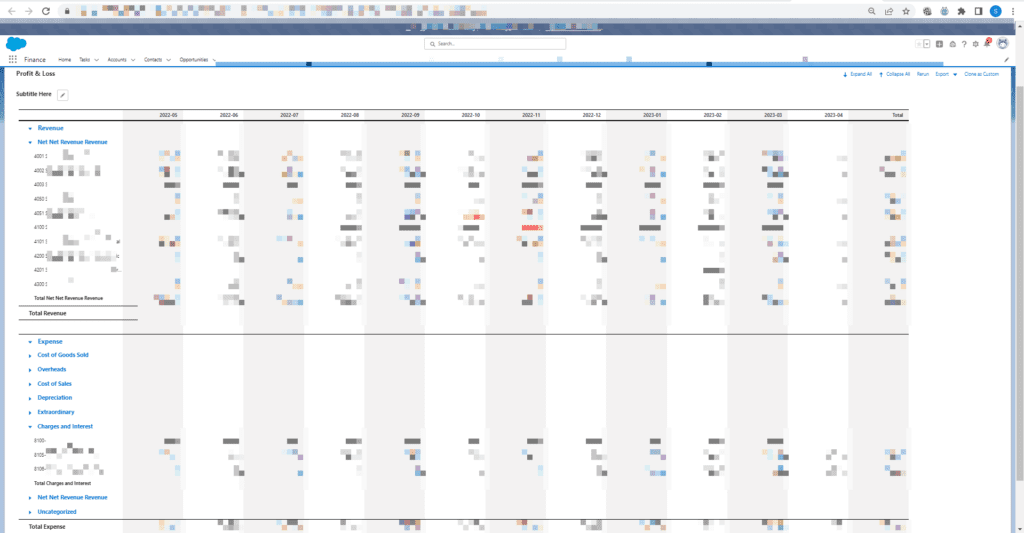

A simple illustration of this efficiency involves the process of raising an invoice. Where the team used to do multiple keystrokes in the past, they can now simple click a button in the opportunity record (invisible to the sales team) to raise a fully templatized, customized invoice and email it to their client finance contact from within the system. Not only that, the finance team could also now post the entries into the correct ledgers with clicks that made it possible to get accurate, real-time P&L and customer statements. This led to a collaborative approach between the sales and finance teams ensuring the sales team’s data input increased in accuracy and in return the finance team were able to provide validated numbers back to the team quicker.